Stop Leaking Deals: Finding the Best CRM for Private Equity

Your team hit the golden opportunity. An ideal firm to be bought. But the key email is buried. An essential contact was not registered. The deal slips away. This will cost your firm millions. It hurts a lot of funds.

Finding the best CRM for private equity is not just helpful. It is survival and growth imperative. Following this guide will assist in the selection of the correct system. You are able to convert sloppy data into deals won.

What is the Best CRM for Private Equity?

The best CRM for private equity is a central hub for your firm. It follows all the deals, contacts and interactions. It is an investment-workflow software.

It operates deal sourcing, fund raising and portfolio companies. Consider it as your one way of the truth. It allows your team to work even smarter.

An ordinary CRM may be ineffective. There are special needs of private equity. Your relationships are not simple. You work with investors, bankers and the owners of companies.

The specialized platform perceives this world. It assists you to establish and maintain these essential relationships. This translates to improved deal flow and improved partnerships.

Why should a CRM be in use in Private Equity Firms?

A CRM is required to facilitate a multifaceted relationship and rapidly evolving deals at the private equity firms. Emails and spreadsheets just cannot survive.

Everything is centralized in a CRM. It eliminates lost opportunities. Your group is able to view the history of any relationship. This assists you to make smarter and quicker decisions.

In the absence of a CRM, the information is in silos. There is an inbox with key notes of one person. There is the other who has a phone contact. This is risky. When one of the team members quits, then that knowledge is lost.

This institutional memory is captured in a CRM. It guarantees that your company is the owner of relationships and data. This renders your whole operation more effective and worthwhile.

What are the Advantages of a CRM Software to a Private Equity?

There are immense benefits to using a CRM. It introduces sanity to the deal-making disorder. Here are the key advantages:

-

Better Deal Sourcing

A CRM will allow you to follow possible deals wherever you are. You are able to control a bigger pipeline. Not a lead will drop through the cracks.

-

Improved Relationship Management

View all the touchpoints with Limited Partners (LPs) and contacts. This creates strength and facilitates fundraising. You have always the number to call and the reason.

-

Enhanced Due diligence

Keep all your research and documentations at a single place. Your staff can work in harmony. This facilitates the due diligence process.

-

Ultrasonic Processes

Automate low level processes such as follow-ups. This liberates your team to high value work. Everyone is more productive.

-

Data-Driven Insights

Receive reports of your pipeline performance. Know where you get your best deals. Decision making should not be made out of guesses.

What Does a Private Equity CRM Need to include?

An excellent PR equity CRM must possess certain functions that are designed to fit your workflow. It requires contact management, more. Search a solution with the following main capabilities. They play a crucial role in the maintenance of investment pipeline and relations.

These are the features that are a must:

-

Pipeline Management

This is a visual tool that allows tracking deals at each stage. Since preliminary sourcing to finalizing.

-

Relationship Intelligence

This feature is automatic and plots out who knows who. It discovers obscure links in your network.

-

LP Reporting Tools

Abilities to take care of communications with your investors. Monitor capital outlay and distributions.

-

Fields can be customized

It is possible to add fields such as EBITDA or industry.

-

Mobile Access

Your staff is mobile. They require accessibility of information anywhere.

-

Intense Integration

It should integrate with your email, calendar, among others. This forms a smooth work process.

The 5 Best CRM for Private Equity

Making a CRM selection can be daunting. Many options exist. There are others constructed simply to be financial. There are others that are versatile tools that can be modified. We have checked the best sites. These are the five best fundings to your private equity firm.

DealCloud

DealCloud is an efficient capital market platform. It is highly flexible.

It is used by many leading investment companies. It can be shaped to your specific process.

-

Major Strengths

Industry specific solutions. Powerful data integration technology. High-end reporting and analytics.

-

Ideal Field

Best when a highly-structured solution is required by large or mid-sized companies.

-

Pros

Very powerful. Tailored for PE workflows. Excellent support.

-

Cons

Can be very expensive. Takes a lot of time to install.

Affinity

Affinity is relationship-oriented intelligence. It automatically identifies your teams network.

It draws on data to display to you the warmest route to a deal. This saves a colossal deal of manual data entry.

-

Primary Characteristics

Data capture is automated. Relationship scoring. Directions to discover links.

-

Ideal Field

Companies which depend on their network to obtain deals.

-

Pros

Easy to use. Saves hundreds of hours. Great for VC and PE.

-

Cons

Not as customizable as DealCloud. Reporting could be stronger.

Altvia

Altvia is developed on Salesforce platform. It offers a comprehensive answer to the private equity. It includes investor relations, deal management and fundraising. It is a true end-to-end system.

-

Major Characteristics

Full-suite investor portal. LP reporting and capital call tools. Robust pipeline management.

-

Best Used

Companies that require an end-to-end solution at Salesforce.

-

Advantages

All-inclusive capabilities. Taps the power of Salesforce.

-

Cons

May be complicated to carry out. Connected with Salesforce environment.

Dynamo Software

Dynamo is a platform with alternative investments that are configurable.

It favors PE, hedge funds and property. It has a reputation of a robust back-office and accounting.

-

Important Practice

Portfolio monitoring. Fundraising management. Due diligence tracking.

-

Best

Funds that require good compliance and portfolio management tools.

-

Advantages

Excellent complex fund structure. Highly secure. Good mobile app.

-

Cons

User interface might be a little outdated. Can be costly.

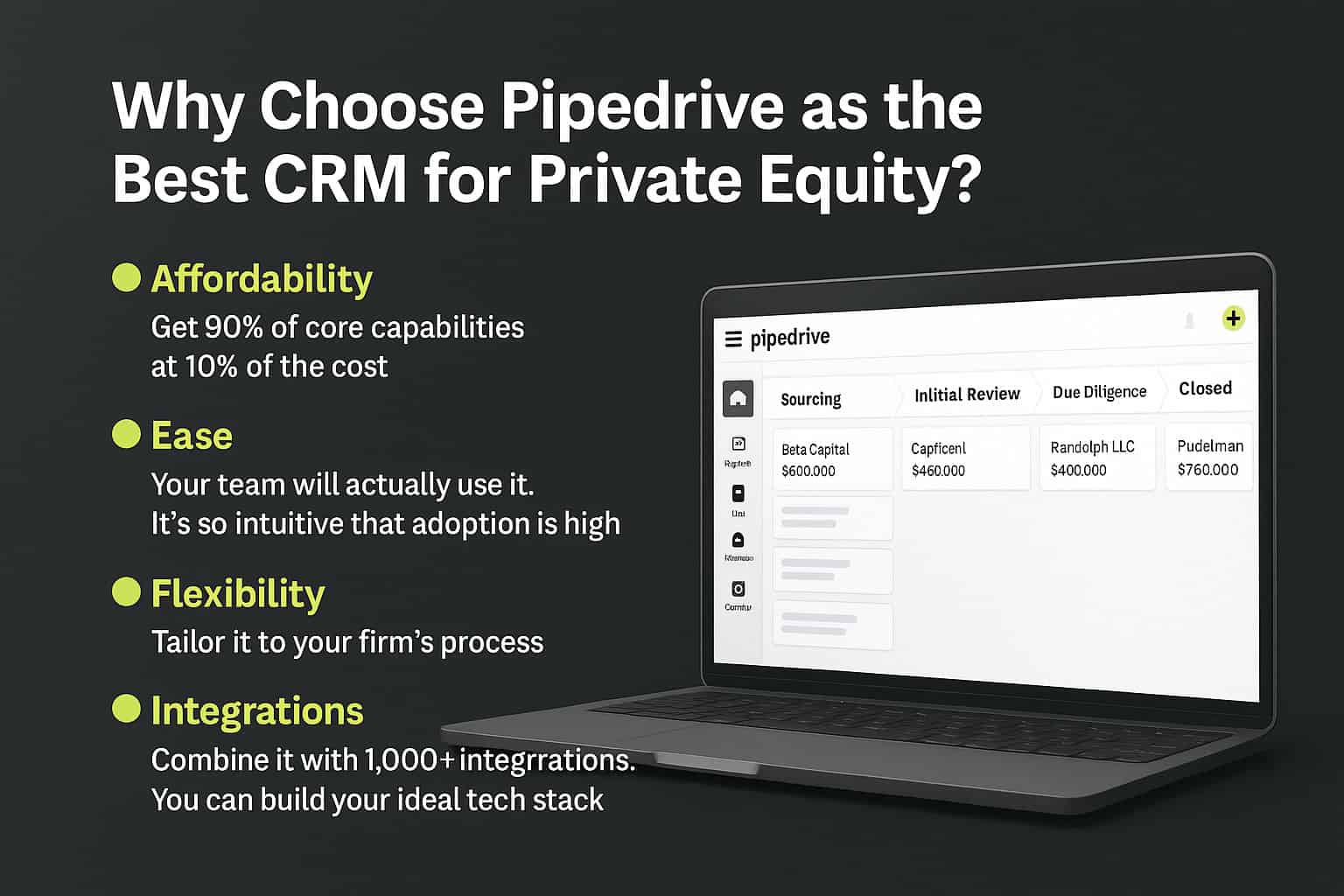

Pipedrive

Pipedrive is known for its visual sales pipeline, which is simple and intuitive to use. While it wasn’t originally designed specifically for Private Equity, its versatility and deal-flow orientation make it a strong fit for smaller, agile firms.

You can easily track deals from the sourcing stage all the way to closing — with complete visibility at every step. To tailor the platform to your unique workflow and investment lifecycle, partnering with a Pipedrive consultant USA can ensure optimal setup and customization that aligns with your firm’s operational needs.

-

Major characteristics

Visual pipeline that is easy to use. Simple to use and set up. Intense automation capabilities. Hundreds of integrations.

-

Best For

Startups, small to mid-sized Private Equity firms and venture capital funds. Groups that require a robust, economical and user-friendly system without the expensive and complexity associated with specialized systems.

You may read more at the Pipedrive site.

-

Pros

Extremely affordable. Very easy to learn. Very personalized to your deal phases.

-

Cons

Lacks particular LP reporting tools by default.

Critical CRM Comparison Table of Best CRM for Private Equity

| Feature | DealCloud | Affinity | Altvia (Salesforce) | Dynamo Software | Pipedrive |

| Best For | Large, complex firms | Network-driven firms | Firms on Salesforce | Funds needing compliance | Agile, budget-conscious firms |

| Key Strength | Extreme Customization | Relationship Intelligence | All-in-One Suite | Portfolio Management | Simplicity & Ease of Use |

| Setup Time | High | Low | High | Medium | Very Low |

| Pricing Model | High (Per User) | Medium (Per User) | High (Per User) | High (Per Platform) | Low (Per User) |

| Ease of Use | Complex | Very Easy | Moderate | Moderate | Extremely Easy |

Why Choose Pipedrive as the Best CRM for Private Equity?

Pipedrive is the wisest option to many developing companies. Private Equity software is sometimes costly and complex.

Pipedrive is the alternative that refreshes. It concentrates on the most significant aspect of your business, which is to manage your deal flow.

The visual pipeline of Pipedrive is ideal in the case of private equity. You may add stages such as Sourcing, Initial Review, Due Diligence and Closed.

It is strong to see all your deals in one look. You immediately understand what you are required to pay attention to.

It is also extremely simple to establish. Pipedrive can be installed in a few teams within an afternoon, rather than a quarter.

In the case of a small fund where time is money, such speed is a huge benefit.

Here’s why Pipedrive works best for private equity:

-

Affordability

Receive 90 per cent of core capabilities at 10 per cent of the price.

-

Ease

Your crew will actually utilize it. It is so intuitive that the adoption is high.

-

Flexibility

Adapt it to the process of your firm.

-

Integrations

Accompany it with thousands of integrations. You are able to create your optimum tech stack.

Ready to Boost Your ROI Using Best CRM For Private Equity?

Relationships and opportunities are what control the success of your firm. Don’t allow them to lose themselves in spreadsheets. Choosing the best CRM for private equity is a critical step.

In the case of large companies, tooling such as DealCloud may be appropriate. And in the case of most growing funds, a plain, strong answer is superior. You require a system, which assists you in closing deals and not busywork.

Have you a disorganized pipeline in your team? Do you fear dealings falling between the cracks?

Pipedrive is constructed to address that issue. It brings clarity and deal flow control to you. Quit handling data and begin to seal deals.

Ready to see how Pipedrive can transform your firm?

Pipedrive free trial today and build your perfect deal pipeline in minutes.

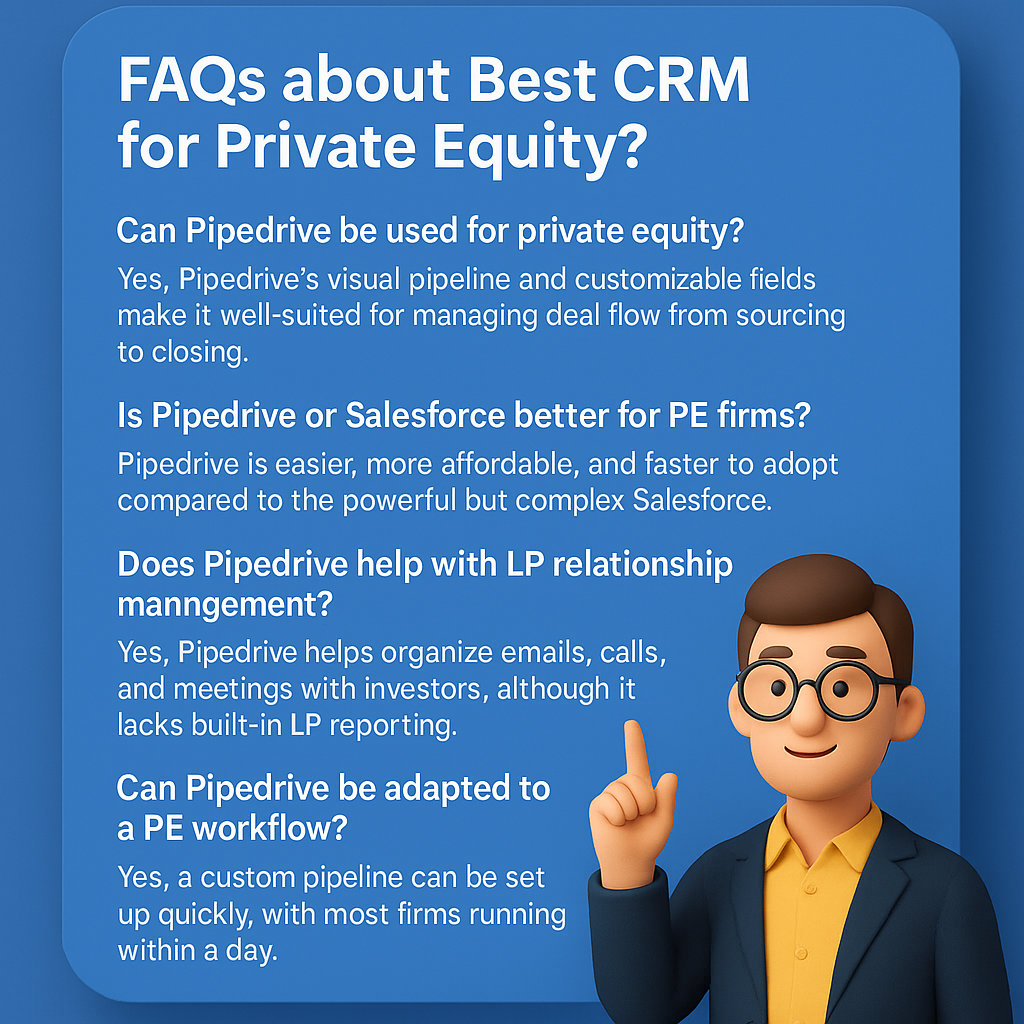

FAQ about best CRM for Private Equity?

-

Is it possible to use Pipedrive with a private equity?

Yes, absolutely. Pipedrive is a flexible CRM. It has an ideal visual pipeline to monitor deal stages. Fields and activities can be configured to meet your workflow. It is a great, affordable deal flow management solution, sourcing through closing.

-

Which is better between Pipedrive and Salesforce in PE firms?

Pipedrive is far easier and cheaper than Salesforce. Salesforce is powerful and needs a lot of customization and a big budget. Pipedrive is dedicated to winning the deal tool as it is quicker to install and simpler to embrace by your workforce.

-

What is the deal flow management software?

Deal flow management software is the software that assists investment firms with tracking down of potential deals. It sets the whole process in order. This involves sourcing, appraisal and termination of investment. A CRM such as Pipedrive works well in this purpose because it allows a clear view of a pipeline.

-

Does Pipedrive serve with LP relationship management?

Yes. Although it lacks internal LP reporting portals, Pipedrive can be used to control all the communications. You can monitor all emails, calls and meetings with your Limited Partners. This keeps your investor relationships very strong and well organized.

-

Can Pipedrive be configured to a private equity workflow easily?

No, it’s very easy. A custom pipeline can be configured in minutes. Name your steps, new data fields to measure your things, and import contacts. Majority of the firms are operational within less than a day and without involving costly crm consultants in USA.

-

What is the enhancement of CRM software on due diligence?

A CRM enhances due diligence as it provides a focal point of all information. You are allowed to add documents, notes made during the calls and to make activity checklists. It is possible to monitor the progress of the entire team in real-time. This makes nothing missed and the process efficient.

-

What is the greatest advantage of relationship intelligence?

Relationship intelligence displays automatically the connection your team has with other people and companies. It will save you the hassle of recording all the interactions manually. This will assist you in identifying the warmest introduction of a new deal and this can drastically make your success rate more successful.