Pipedrive Stripe Integration Tutorial – Simplify Sales & Payments

Imagine this:

Your sales team closes a big deal in Pipedrive. But instead of opening the champagne bottle, they start to manually update payment records and scan emails for alerts from Stripe. It is a risky process. You can overlook crucial points in the process and lose valuable time.

- Time lost.

- Data lost.

- Opportunities lost.

Nowadays, smart business owners use automation for speeding up their sales and conversions. Manually syncing your CRM is an outdated process. If you don’t optimize yourself as well as your business, you will fall behind.

Pipedrive Stripe integration is no longer a nice-to-have but a need-to-have for you. When you want to grow a business without stress, it’s your competitive advantage.

The icing on the cake?

No hard coding or costly budget is needed to automate this essential intersection between sales and payments.

Here, you’ll learn step-by-step how to integrate Pipedrive and Stripe, industry top practices, actionable setup guides, expert tips, and FAQs. So, you can save time, safeguard your cash flow, and satisfy your customers.

Need a Custom Workflow Solution?

Let’s Build A Frictionless Customer Experience. Schedule Your Free Consultation Today for Pipedrive Stripe Integration!

Why Integrating Pipedrive with Stripe is a Game-Changer

Companies that integrate their CRM and payment processes have

- 23% quicker closing rates for deals (Source: HubSpot CRM Report)

- 19% fewer billing mistakes (Source: Salesforce Customer Report)

- 29% more customer satisfaction ratings (Source: Zendesk CX Trends)

Without an effortless Pipedrive Stripe integration, you’re exposed to:

- Redundant manual entry

- Missed or late payments

- Incorrect sales projections

- Bad customer experiences

A Stripe to Pipedrive integration prevents this by integrating payments, customer data, deal status, and revenue automatically so that your team can concentrate on what they excel at—selling.

- HubSpot’s 2024 State of Sales Report says that 65% of sales teams identify fragmented systems and manual processes as their biggest barriers to closing deals faster.

- While Stripe’s 2025 Global Payments Report highlights that companies with automated CRM-payment integrations have a 23% shorter cash collection cycle and 17% improved customer retention.

Think about it:

When your payment updates flow directly into your CRM,

- Sales teams stay focused on selling,

- Finance teams have real-time payment visibility.

- Customers enjoy faster, smoother onboarding without the awkward follow-ups.

Getting Acquainted with Pipedrive and Stripe: A Brief Primer

Pipedrive is a powerful, sales-centric CRM that enables businesses to track leads, deals, and activities in a tidy pipeline view. All about visual momentum and effortless tracking.

Stripe, in contrast, is a leading online payment gateway. It helps businesses accept payments anywhere across the globe. It can help you to automate invoicing, manage subscriptions, and more.

Why Merge Them?

- Because sales and payments are two sides of the same coin.

- When you connect Stripe with Pipedrive, you close the loop of business at once — no longer chasing loose ends.

Find the Gap for Stripe Integration in Pipedrive

Most companies run Pipedrive and Stripe separately. Sales closes a sale in Pipedrive, then accounting (or another department) takes the payment in Stripe, typically days later.

Problems:

This old-fashioned practice is

- Time-consuming

- Error-prone

- Out of touch with fast-buyer requirements today

Your rivals are far ahead, automating sales-to-cash cycles. Will you hold back?

Imagine the Solution

Imagine:

- Every time a customer pays using Stripe, a Deal is synced automatically in Pipedrive.

- When a refund is made, your CRM shows the update instantly.

- Payment status, invoice links, and customer notes populate in your sales pipelines without lifting a finger.

The future of your sales workflows is organized, intelligent, and extremely efficient.

Realize the Gains

Below are the advantages you get by connecting Pipedrive with Stripe:

- Instant Data Sync: Automated update of customer and payment details

- Accurate Forecasting: Real revenue visibility on CRM reports

- Automation: Automatically send trigger emails, status updates, tasks

- Customer Delight: Faster responses and clear communications

- Time Savings: Spend hundreds of hours less each year

- Fewer Errors: Double data entry horror stories are now a thing of the past

It’s not only convenient. It’s also life-changing.

Ready To Automate Your Sales and Payment Workflows?

Integrate Pipedrive with Stripe Today and Grow Smarter, Not Harder!

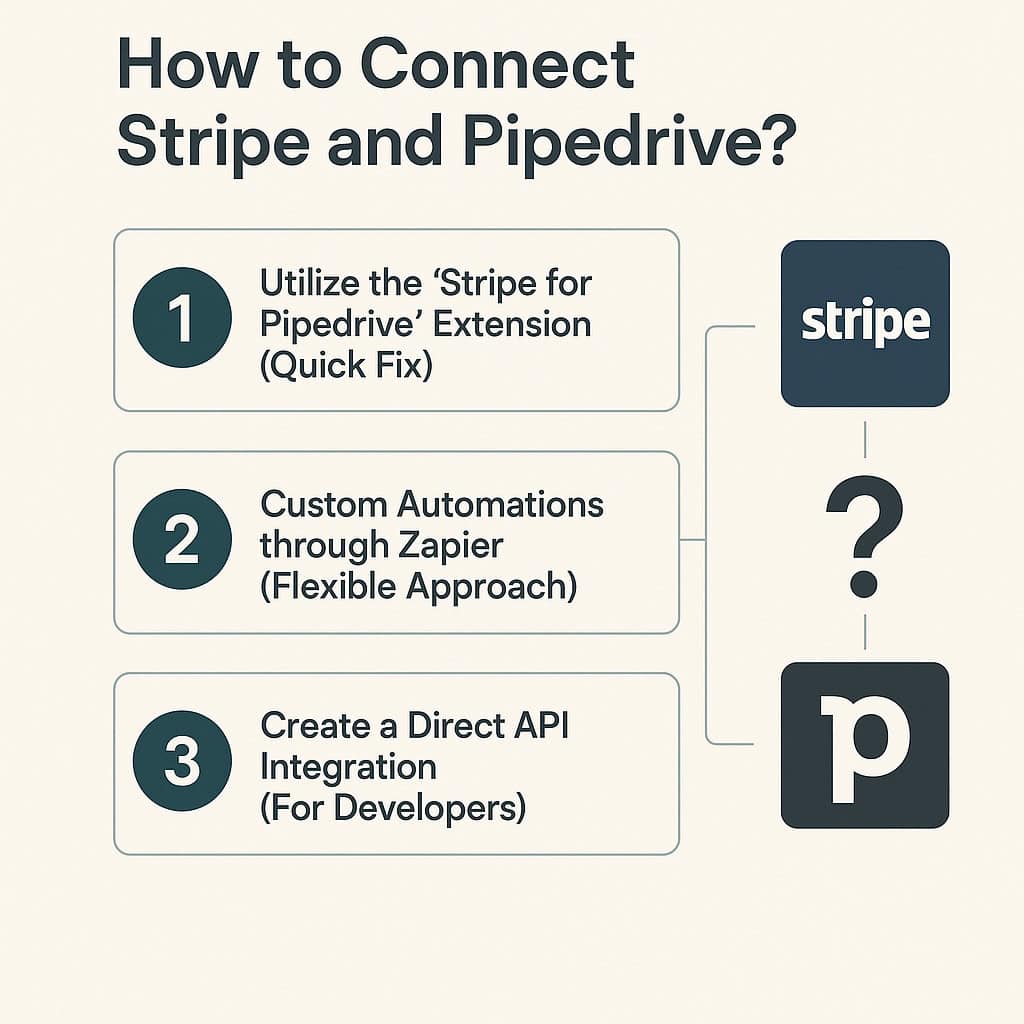

How to Connect Stripe and Pipedrive?

When integrating Stripe and Pipedrive, you have three main options.

Let’s break them down for you so that you can select which one would suit your organization.

1. Utilize the “Stripe for Pipedrive” Extension (Quick Fix)

If you prefer a no-hassle and easy setup, where to begin is with a pre-existing Stripe for Pipedrive extension.

They can be downloaded on either the Pipedrive Marketplace or on reliable third-party websites.

Here’s what you do:

- Visit the Pipedrive Marketplace.

- Search for “Stripe” in the search box.

- Choose an app like “Stripe Connector for Pipedrive” or “Make Stripe Integration.”

- Click “Install” and follow prompts.

- Authenticate your Stripe and Pipedrive accounts.

- Set up basic triggers — e.g., “Create Deal when a Payment is Successful.”

- Test everything to make sure that it’s working perfectly.

Why This Method Works:

- Lightspeed to install

- No tech knowledge needed

- Pre-configured workflows for common scenarios

Things to Keep in Mind:

- Some apps are billed monthly

- You can hit limits if you need very customized flows

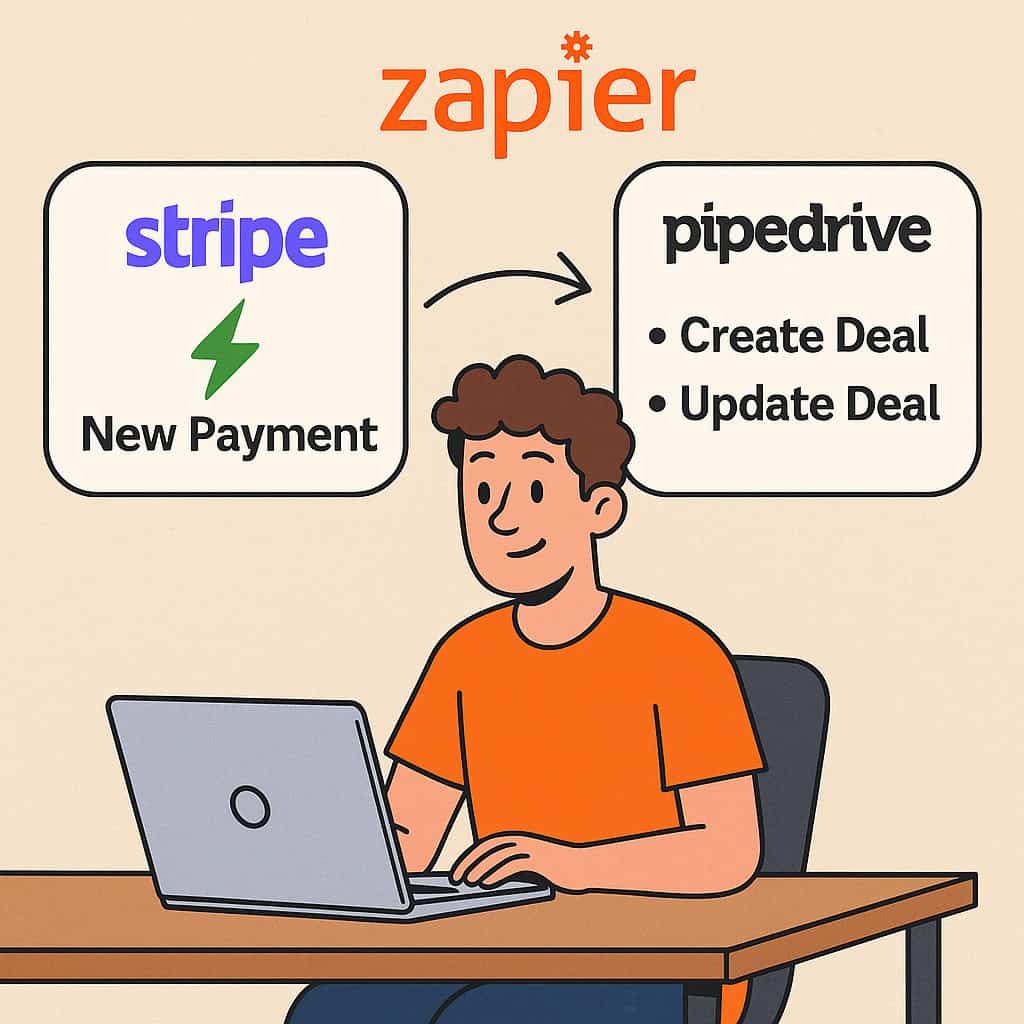

2. Custom Automations through Zapier (Flexible Approach)

Need a bit more flexibility in your processes without getting your hands dirty on any code?

Zapier allows you to build adaptable “Zaps” to bridge Stripe and Pipedrive.

Even spice things up with a little help from some other applications (such as Gmail, Slack, or Google Sheets).

Your step-by-step instructions:

- Sign up for Zapier if you haven’t done so yet.

- Click on “Create Zap.”

- Select your trigger: “New Payment” in Stripe.

- Select your action: “Create Deal” or “Update Deal” in Pipedrive.

- Map important fields such as Amount, Payment Status, Customer Name, etc.

- Test-run to make sure everything is working.

- Activate your Zap and let it run automatically.

Why This Method Works:

- Create only the workflows you require

- Unite several apps into a single automation

- Perfect for scaling without ever having to type a line of code

Things to Remember:

- Might require a paid Zapier plan for extensive use

- You can hit API rate limits with very high volumes

3. Create a Direct API Integration (For Developers)

If you have an in-house tech team (or some dev friends), the ideal solution is to implement a custom API integration from Stripe to Pipedrive.

In this way, you have complete control over every single step of the payment and CRM syncing process.

This is how it will work:

- Install server-side scripts to listen to Stripe Webhooks (payment success, refunds, etc.).

- Install automation that populates or updates Pipedrive records using their public API.

- Run the scripts on your own servers or cloud providers securely.

Why This Method is Effective:

- Total flexibility — you get to control the flow as you like

- No subscription fee for repeat app or extension

- Can be utilized to control complex business logic

Things to Remember:

- Requires coding expertise (Node.js, Python, PHP, etc.)

- Security and maintenance will be on your shoulders

What Method Do You Need?

| Your Situation | Recommended Integration Solution

|

| Need something to use today? Don’t know technology? | Use of pre-built extensions

|

| Need flexibility without programming? | Integration using Zapier

|

| Have developers, need 100% control, tailored solutions? | Custom API bridge by your own devs

|

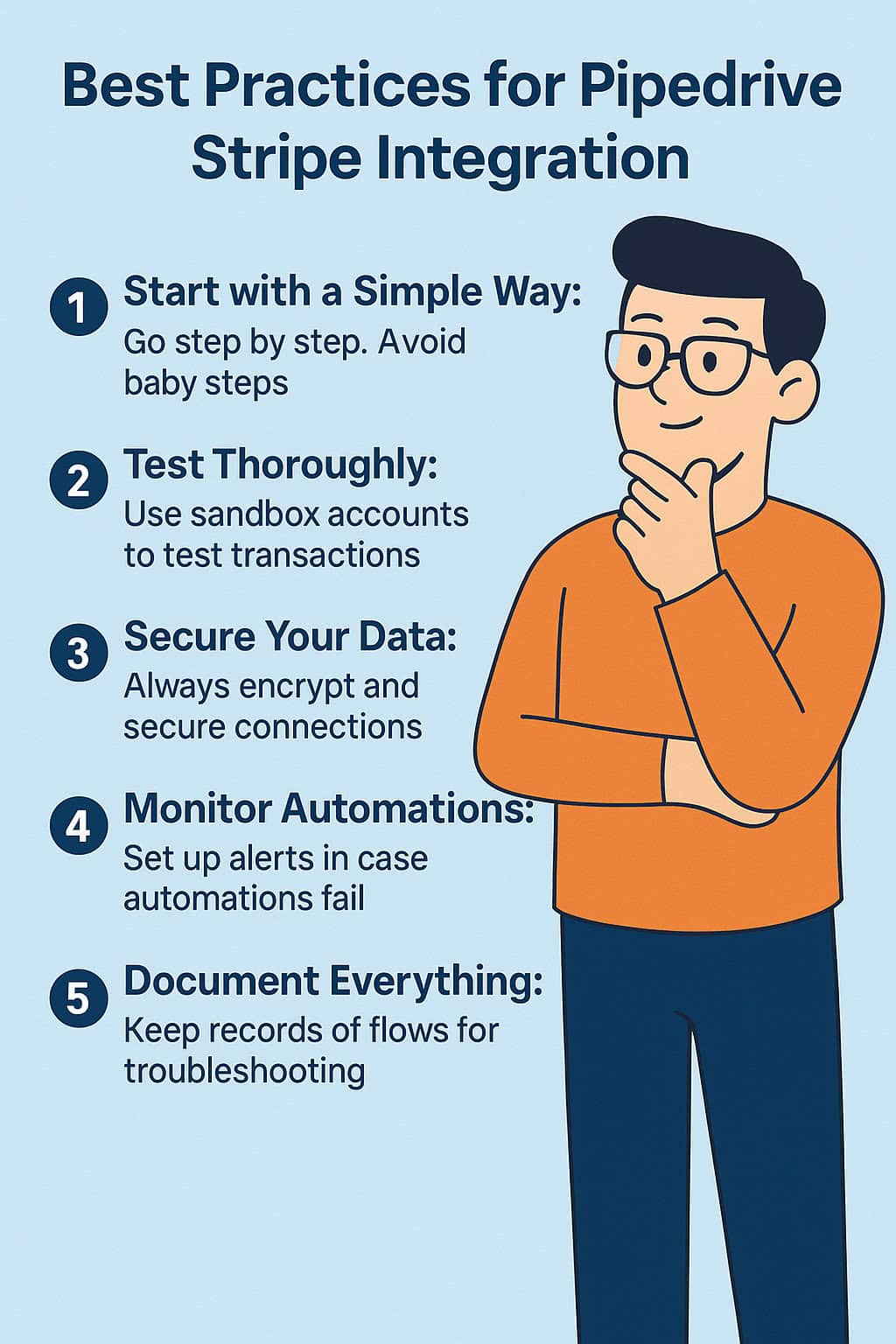

Best Practices for Pipedrive Stripe Integration

Connecting Stripe and Pipedrive isn’t something you can set up overnight. It takes long planning, careful setup, and future-proof maintenance.

Follow these best practices to have a stable, scalable, and future-proof integration:

1. Start with a Simple Way:

When integrating Stripe with Pipedrive, go ahead step by step. Avoid setting up complex, multi-stage automations all at once — take it one step at a time

Start with baby steps:

- Sync successful Stripe payments as new Pipedrive Deals.

- Sync payment settling and refund to update the deal status.

Reflect on why you start with baby steps.

- You can ensure whether straightforward routines are working as they ought to be.

- It reduces the likelihood of freezing your team by giving them too many changes at once.

- It is easier to know when you are incorrect.

Once your foundation flows are set, tested, and proven, you can add more advanced automations like subscription tracking, follow-up emails automatically, task creation, or upsell offers based on payments.

Pro Tip:

- Test and construct one automation and add complexity gradually.

2. Test Thoroughly: Use Sandbox Accounts to Test Transactions

Think about going live knowing that a customer’s payment wasn’t processed properly or transactions are being processed based on incomplete information.

Testing will cost you money.

Sandbox environments are also provided by most platforms, such as Stripe and most integration platforms. A replica environment with which you can test payments, triggers, and flows of data without putting actual money or customers’ live data at risk.

How to Test Wisely

- Mock different payment types (one-off, recurring, refunds).

- Test successful and failed payment scenarios.

- Check if the right deal stages, notes, and payment fields populate in Pipedrive.

- Validate webhook triggers and timing (immediate, delayed, duplicate).

Pro Tip:

- After successful sandbox testing, do a final test with small real transactions before going fully live.

3. Secure Your Data: Always Encrypt and Secure Connections

You’re dealing with sensitive information.

- Customer names

- Payment amounts

- Email addresses

- Financial transactions

Data breaches cost not only money but also reputation.

Security will not be compromised.

- Implement HTTPS protocols on all custom scripts.

- Use excellent encryption standards by ensuring apps and plugins do.

- Scan OAuth permissions and API keys regularly to prevent any unauthorized activity.

- Store at least payment data in your CRM (Pipedrive)—allow Stripe to be the system of record for money data.

Pro Tip:

- Use secure, GDPR-compliant third-party integration tools and limit admin use wherever possible.

4. Monitor Automations: Set Up Alerts in the Case Automations Fail

Even the most solid automations are bound to break occasionally because of API limitations, permission revocation, service outages, or expired tokens.

Letting it find those sorts of issues days later can damage your sales process.

How to win:

- Implement automated notifications within tools like Zapier, Make (Integromat), or via email notifications.

- Implement logging functionality for transaction history and failure monitoring.

- Manual check periodically, especially after significant software updates.

Pro Tip:

- Assign a workflow owner. Someone who undergoes monitoring, maintenance, and workflow optimization monthly.

5. Document Everything: Keep Records of Flows for Troubleshooting

When something goes awry with automations, good documentation can mean the difference between a five-minute fix and a five-hour migraine.

Your documentation must entail

- What tools are being integrated and in what way (e.g., Zapier, APIs, native integrations)

- What does each automation (trigger → action flowchart) do

- Fields synced between Pipedrive and Stripe

- Admin passwords, API keys (safe storage)

- Troubleshooting steps for frequent problems to follow

Good documentation is also convenient to onboard new team members or ramp up operations without having to begin from scratch.

Pro Tip:

Keep easy visual diagrams of complex workflows — a simple Google Doc with flowcharts is sufficient.

Common Mistakes to Avoid

Despite the best of intentions, some of the common mistakes to avoid are not taking your Stripe Pipedrive Integration.

Here’s how to spot and avoid the most common ones:

1. Not Mapping Fields Properly (i.e., Wrong Currency Field)

Mis-mapped fields are one of the top causes of integration breakdown.

Example Issues:

- Incorrect amounts paid are registered in the wrong currency (USD vs. EUR).

- Customer email addresses mismatched or wrongly matched to promotions.

- Omitting key payment information like invoice numbers or subscription periods.

Solution:

- Double-check field mappings during setup.

- Perform a full test as a matter of course to check data flow.

- Normalize your field formats where possible (for instance, use two-decimal formats for all currencies).

2. Over-Engineering Automation Too Soon

Excessive complexity too early on will result in a brittle, obscuring system.

Common Mistakes:

- Building 10-step workflows before nailing down 2-step basics.

- Chaining multiple platforms and apps together without being able to diagnose is getting harder.

Resolution:

- Start with a Minimum Viable Automation (MVA), the simplest possible workflow to prove value.

- Scale dynamically only after reliability and clean business requirements are established.

3. Skipping GDPR/Compliance for Payment Data

Compliance is not something you do in today’s legal environment. It’s unavoidable. Stripe itself is GDPR compliant, but it is possible to process customer financial data in Pipedrive in the incorrect context in violation of the law.

Risk Includes:

- Severe fines (up to €20 million or 4% of gross worldwide turnover per annum).

- Loss of customer trust.

- Disruption of business.

Solution:

- Store only the minimum payment information in Pipedrive.

- Do not store complete credit card numbers and sensitive financial data in the CRM.

- Send your data policies to attorneys for review regularly if applicable.

4. Not Updating After Platform API Changes

Stripe and Pipedrive regularly evolve their APIs and feature sets. Without third-party connectors or bespoke integrations, these changes can quietly reduce your automations to nothing.

Example Risks:

- Retired fields no longer return data.

- Moving authentication requirements can sever the connections.

- New permission settings limit specific functions.

Solution:

- Subscribe to Pipedrive and Stripe product update newsletters.

- Quarterly, test your integrations for compatibility.

- Add regular updates and retests to your automation maintenance schedule.

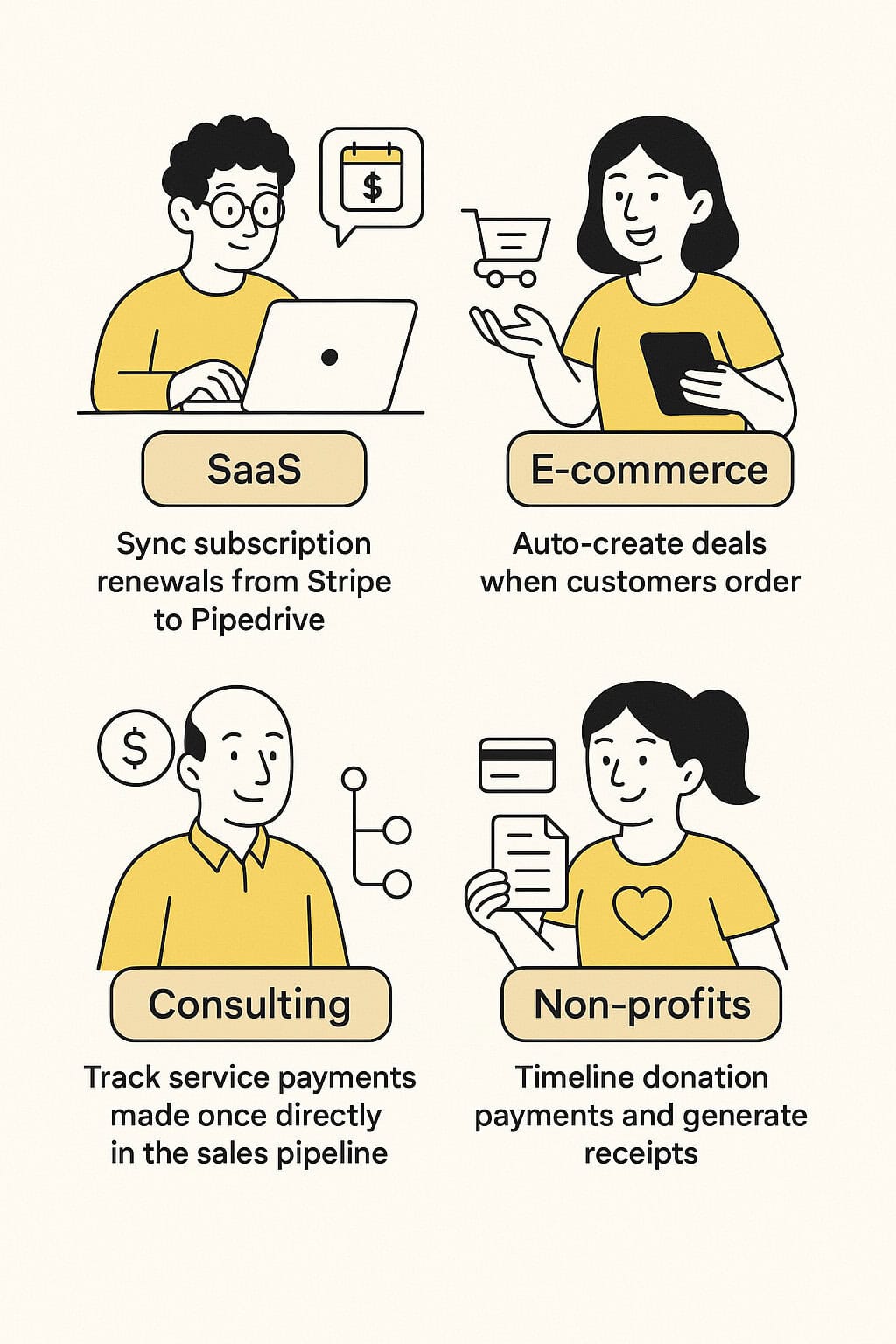

Use Cases of Pipedrive Stripe Integration in the Real World

| Industry | Use Cases |

| SaaS | Sync subscription renewals from Stripe to Pipedrive |

| E-commerce | Auto-create deals when customers order |

| Consulting | Track service payments made once directly in the sales pipeline |

| Non-profits | Timeline donation payments and generate receipts |

No matter your business model, a seamless Pipedrive-Stripe connection brings new efficiency.

Take Control of Your Sales-to-Cash Process

Integrating Pipedrive and Stripe isn’t just about saving time. It’s about building a stronger, faster, smarter business.

It’s a game-changer for those who must sell faster, get paid faster, and make more informed customer relationship decisions.

Painless integration = quicker payments, tighter sales, and happier teams.

The Pipedrive Stripe integration gives you:

- Real-time payment updates

- Smarter forecasting

- Better customer journeys

Regardless of whether you take a simple extension, use a platform like Zapier, or build a custom API, the future of your business depends on more harmonized sales and payments.

Ready to Future-Proof Your Sales and Payment Workflows?

Having Trouble Connecting Your Pipedrive to Stripe?

Book Our 45-Day Pipedrive Trial Services For A Smooth Sale!

FAQs About Pipedrive Stripe Integration

-

Is there a Pipedrive and Stripe integration for free?

Yes, the free plans for applications such as Zapier and Make have a limited number of tasks. For burgeoning businesses, however, shelling out for a paid plan will likely be money well spent.

-

Is it safe to integrate Stripe with Pipedrive?

Yes, if you follow best practices.

Make sure that:

- You use encrypted, secure connections.

- Don’t sync sensitive data like full card numbers.

- Use GDPR-compliant software.

- Restrict role-based access permissions.

-

Can fields be mapped that are synced from Pipedrive to Stripe?

Yes. Integrations such as Zapier and Make allow you to map fields such as Customer Name, Amount, Payment Date, Subscription ID, etc.

-

How long does the setup of the integration take?

With tools like Zapier or a Stripe for Pipedrive extension, setup can take less than 30 minutes.

-

How can I simply integrate Stripe with Pipedrive?

The simplest option is to use a no-code integration tool such as Zapier, Make (Integromat), or the Stripe for Pipedrive official add-on if available.

These platforms enable you to connect Stripe payment events to Pipedrive activities (e.g., create or update deals) graphically without having to write any code.

-

Can I automate the logging of subscription payments from Stripe in Pipedrive?

Yes, you can! You can automate to:

- Create a new deal when the subscription starts.

- Update the deal on every recurring payment.

- Move deals to “Cancelled” or “Churned” when the subscription is cancelled.

Tip: Push useful subscription information (e.g., next billing date) into Pipedrive custom fields using Stripe metadata.

-

How often should I inspect my Pipedrive Stripe integration?

Inspect your whole Stripe-Pipedrive integration every 3-6 months, or immediately after a major update to Stripe, Pipedrive, or your integration software. Inspecting finds issues like broken field mappings, expired API permissions, and corrupted automations before they can impact your business.

-

Will a failed Stripe payment sync to Pipedrive anyway?

It all depends on your integration configuration. You may have workflows to record failed payments and also to update the deal status in Pipedrive (e.g., “Action Needed” or “Payment Pending”).

There are integrations for filtering out events so that only successful payments create or update deals.

Best practice: Record both successful and failed payments always for better customer follow-up.